Are you trying to find categories/software/tax preparation among various brands on the market but aren’t sure where to begin? To assist you in finding the right one, we’ve put together a list of the 7 best to help you pick the perfect one!

We investigated and evaluated a number of the top-selling categories/software/tax preparation on the market in order to create our list of the best. Making a decision among the many options available is never simple. There are an infinite number of models available, each with a distinct price. And as you’ll find out, the best options aren’t usually the ones you imagine! This comparison is rich and relevant because of the numerous factors that were employed. You will find products featured in this ranking not only based on their pricing but also on their features and other customers reviews. To write this review, we completed 21 hours of research and did 63 categories/software/tax preparation tests. You won’t need to pick products at random any more. If you’re unsure of what to look for, browse our list and consult the buying guide!

An overview of our top picks

Table of contents

The best categories/software/tax preparation you can buy today

- Choose to put your refund on an Amazon gift card and you can get a 2.75% bonus. See below for details

- One state program download included— a $39.95 value

- Reporting assistance on income from investments, stock options, home sales, and retirement

- Guidance on maximizing mortgage interest and real estate tax deductions (Schedule A)

- Step-by-step Q&A and guidance

- Quickly import your W-2, 1099, 1098, and last year's personal tax return, even from TurboTax and Quicken Software

- Accuracy Review checks for issues and assesses your audit risk

- Five free federal e-files and unlimited federal preparation and printing

- TurboTax Premier is recommended if: You sold stock, bonds or mutual funds, sold employee stock (ESPP), own rental property or are a trust beneficiary

- Includes 5 free federal e-files and one download of a TurboTax state product (dollar 40 value). State e-file sold separately.

- Keep more of your investment and rental income

- Extra help for investment sales such as stocks, bonds, mutual funds, and employee stock plans

- Coaches you and double checks along the way

- Automatically imports W-2s, investment & mortgage information from participating companies (may require a free Intuit account) and imports prior year data from TurboTax and other tax software

- Searches 350 deductions and credits, including tax-saving rental property deductions plus maximizing charitable donations with its deductible

- Additional guidance for rental property income, expenses, depreciation and refinancing

- Maximize next year’s refund with personalized advice

- Sold as 1 Each.

- Perfect cash record keeping system for small and home-based businesses.

- Record of cash received and paid out.

- Includes payroll section for up to six employees.

- Filled in specimen page.

- English (Publication Language)

- TurboTax Deluxe guarantees your biggest tax refund by finding and maximizing your deductions

- Uncovers over 350 deductions including mortgage interest, charitable contributions, and more

- Guides you through changes in your tax situation and lets you know how they will impact your taxes

- Audit Risk Meter helps you reduce your chance of an audit

- Transform paper into information that works

- Automatically extracts key information from scanned receipts; can export to Quicken, Excel, and pdf

- Scans are IRS-accepted digital copies, making tax preparation a snap

- Scan up to 10 receipts, 10 business cards and 10 documents at once or a single, 50 page document

- Developed for OS X to look and feel like the applications you use every day

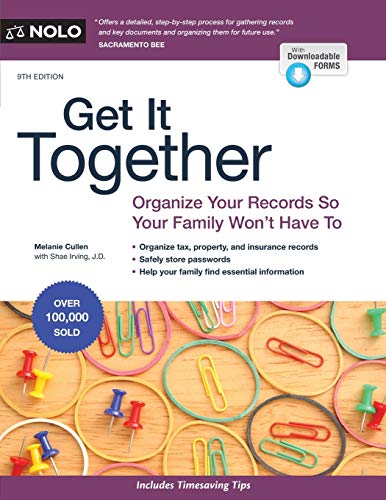

- Cullen, Melanie (Author)

- English (Publication Language)

- 440 Pages - 10/13/2020 (Publication Date) - NOLO (Publisher)

- Includes everything you need for your self-employment and personal income taxes

- Expanded interview guides you step-by-step through schedule C to help maximize business expenses, home office deductions, depreciation and more

- Creates W-2 and 1099-MISC forms for your employees and contractors

- Shows you your maximum depreciation method

- Includes over 60 categories of business deductions

How to choose a good categories/software/tax preparation

Does the idea of finding a fantastic categories/software/tax preparation make you anxious? When it comes to purchasing this product, specifically when deciding which model to select, has your head been spinning between options? You are not alone if that is the case. We are aware of the pressure involved in the purchasing process!

Your presence here indicates that you are interested in categories/software/tax preparation. Before choosing which product would be the best for your needs after being inundated with information, locate a reliable source with genuine selections. You can get that information from a variety of sources, including buying guides and rating websites, word-of-mouth recommendations from friends and family, online discussion forums where users can share their own experiences, product reviews that can be found all over the internet, and YouTube channels. You can only get the right product through exhaustive analysis. But you realize that’s not always simple. In order to ease your concerns, we have taken the time to develop a list of the top categories/software/tax preparation products available right now. You might be wondering how we came up with the list. How was this buying guide developed?

First, we used our algorithms to gather as much reliable data as we could about these products. To verify all the data gathered, we used both artificial intelligence and a lot of algorithms.

Then, our experts used criteria that are recognized in the business to evaluate them according to their quality to price ratio, allowing us to choose the top categories/software/tax preparation on the market right now!

The selection of the goods is not arbitrary. Before creating a list, we take into account a number of factors. Below are some of the criteria discussed:

Brand Value: What happens if you choose a dubious brand just because it appears to be a good deal? So the likelihood of receiving a product with a short shelf life increases. That is due to the fact that well-known brands have a reputation to uphold, while others do not. Top categories/software/tax preparation brands strive to provide some distinctive traits that set them apart from the competition. So, hopefully one or more of the items on our list will be perfect for you.

Features: Useful features are all you need, not tons of them. We consider the important aspects and select the top categories/software/tax preparation based on those.

Specifications: Numbers always help you measure the quality of a product in a quantitative way. We try to find products with higher specifications, but with the right balance.

Quality: A product’s quality may always be quantified with the aid of numbers. We look for goods with better standards that strike the proper balance. The best quality product that gets highly appreciated and recommended by experienced users.

Customer ratings: Would it be accurate to suggest that the categories/software/tax preparation were used by hundreds of customers before you? Superior ratings indicate that many customers had better service.

Customer Reviews: Like ratings, provide you with accurate and reliable information about the product from genuine customers. Customer ratings are very important to all of us because they contain accurate and reliable information about the customer service we received from several hundred customers.

Seller Rank: This is very intriguing! Not only do you need a good categories/software/tax preparation, you also need a product with rising sales that is trendy. It accomplishes two goals. First, the expanding user base proves the quality of the product. Second, given that number, producers must be able to offer greater quality and after-sales support.

Value: You get what you pay for, they say, so consider the value. Cheap isn’t always good and expensive isn’t always bad. However, that does not imply that spending a lot of money on a product that is flashy but underwhelming is a good idea. Before adding them to the list, we make an effort to evaluate how much value you can get for your money from your categories/software/tax preparation.

Durability: Durability and reliability are closely related concepts. You will benefit from a strong and long-lasting categories/software/tax preparation for months and years to come.

Product availability: Products come and go, and new ones replace the old ones. Most likely, a few new features and required changes were made. What use is it to use a supposedly good product if the maker no longer supports it? We make an effort to highlight products that are current and offered by one or more trustworthy sellers, if not more.

Negative Reviews: Yes, we do take that into account as well! The goods with the majority of bad reviews are filtered out and disregarded when we choose the best-rated one on the market.

These are the standards by which we selected our categories/software/tax preparation. Do we end our process there? Hell no. The most crucial fact about us that you should be aware of is that we regularly update our website with current and pertinent information. We have one more layer of filtration since we place the greatest importance on reader satisfaction. Please let us know if any product included here is incorrect, irrelevant, subpar, or simply out of date. We always value your opinions, and we’ll work hard to make any necessary corrections to our list in response to them.

Why should you believe us?

There are now thousands of possibilities for these products on Amazon, but choosing the best one can be difficult and time-consuming. And what categories/software/tax preparation should you purchase in 2022?

This guide is the result of more than 10 years of experience in researching, testing and writing about many topics. Each member of our team is an authority in their area. We read every article we could find online and every consumer review on every retail website for seven hours. Additionally, we discovered a ton of websites that offered helpful resources, including buying tips and thorough information on categories/software/tax preparation.

Related posts:

- The 8 Best tax preparation software of 2025

- The 8 Best test preparation software of 2025

- The 8 Best categories/books/test preparation of 2025

- The 8 Best categories/software of 2025

- The 8 Best categories/software/utilities of 2025

- The 8 Best categories/software/children s of 2025

- The 8 Best categories/software/video of 2025

- The 8 Best categories/software/music of 2025

- The 8 Best categories/software/business office of 2025

- The 8 Best categories/software/accounting finance of 2025

![The 8 Best categories/software/tax preparation of %currentyear% 11 H&R Block Tax Software Deluxe + State 2022 with Refund Bonus Offer (Amazon Exclusive) [PC Download] (Old Version)](https://m.media-amazon.com/images/I/41n0FVam4VL.jpg)

![The 8 Best categories/software/tax preparation of %currentyear% 12 [Old Version] TurboTax Premier 2020 Desktop Tax Software, Federal and State Returns + Federal E-file [Amazon Exclusive] [PC Download]](https://m.media-amazon.com/images/I/41YpZOBU3gL.jpg)

![The 8 Best categories/software/tax preparation of %currentyear% 20 TurboTax Home & Business Federal + State 2007 [OLD VERSION]](https://m.media-amazon.com/images/I/41EmhNHQawL.jpg)